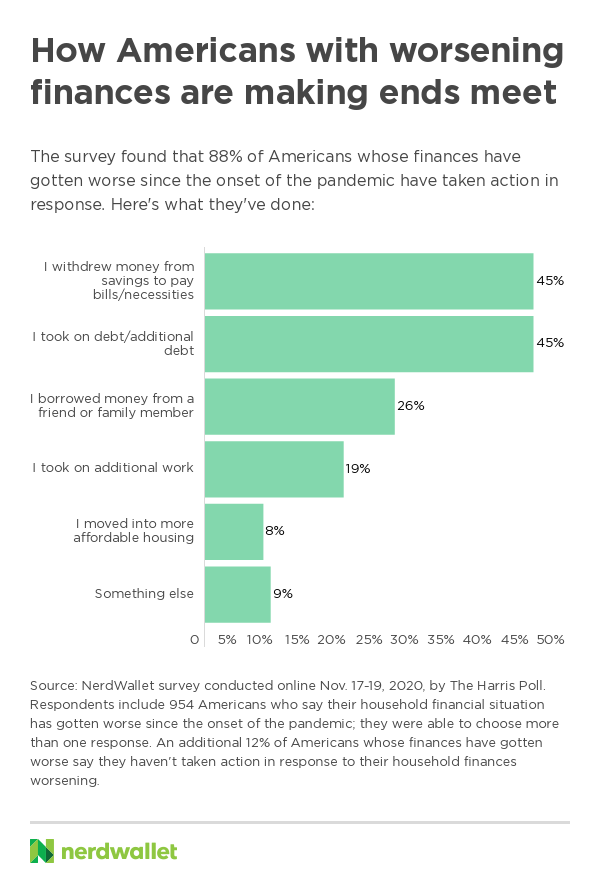

Some card issuers offer zero percent interest on balance transfers, but only for a limited time. But if you must carry a debt, there are ways to save. Of course, the best thing to do if you find yourself with a large credit card debt is to pay it off as quickly as possible. But the problem is, when you drag it out for a decade and a half plus, that's where you really feel it." There are ways to cut your cost of credit "Your minimum payment might change by only a few bucks a month. "You don't notice it so much on the monthly statement," Rossman says. Each time the central bank raises rates, the cost of carrying a balance on your credit card goes up as well.īut when Bankrate did a survey last month, they found more than 4 out of ten credit card holders don't even know what their interest rate is. The Federal Reserve has been aggressively raising interest rates in an effort to curb inflation. That's the largest one-year increase in the four decades Bankrate has been tracking rates. The average interest rate on credit card debt has soared to nearly 20%, from just over 16% at the beginning of last year. The Fed has been raising interest rates aggressively to fight inflation and that's raising all kinds of interest rates across the economy. "And that debt is as expensive as ever."įederal Reserve Chairman Jerome Powell speaks during a news conference in Washington, D.C., on Dec. "Almost half of card holders are carrying debt from month to month," Rossman says. The share of credit card users who carry a balance has increased to 46% from 39% a year ago, according to Bankrate.

Fewer people are paying off their balances every month "Every time my minivan all of a sudden needed $300 worth of work, or I had an elderly cat, and every time he needed emergency surgery, it went on the credit card," Murphy says. That left little wiggle room when unexpected expenses popped up. Mel Murphy's rent gobbled up two-thirds of her income as a part-time custodian in Spokane, Wash. But unfortunately, it's easy to get in and hard to get out." "It's usually something pretty practical that gets you into credit card debt. The Institute for Policy Studies Racial Wealth Divide report. The median Latino family, with 36,050, owns just 19.1 percent of the wealth of the median white family. This is just 12.7 percent of the 189,100 in wealth owned by the typical white family. "Contrary to popular opinion, it's not usually a vacation or shopping spree," says senior industry analyst Ted Rossman of Bankrate. According to Survey of Consumer Finances data, the median Black family has 24,100 in wealth. With inflation outpacing incomes, more people are relying on credit cards to cover everyday expenses.

It's the everyday stuff that people are charging Here's what to know about rising credit card debt – and what you can do about it. Your Money The cutting edge solution to rising debt? Paying in cashĪs credit card balances balloon again, they can cast a long shadow over family finances.

0 kommentar(er)

0 kommentar(er)